The electronic invoicing (“e-invoicing”) goes back to the “VAT in the Digital Age (VIDA)” initiative launched by the EU Commission on December 8, 2022. The digitalization of the VAT system is intended to adapt the VAT framework in the EU to the digital reality. In particular, this aims to reduce tax losses resulting from fraudulent behavior in cross-border trade within the EU.

The VIDA initiative is based on three pillars: a) Digital Reporting Requirements, b) updated VAT rules for the Platform Economy and c) Single VAT Registration. The topic of e-invoicing belongs to the first pillar of the Digital Reporting Requirements and represents the solution now being sought for how data exchange with the tax authorities can be structured in order to make the VAT system more efficient and to reduce complexity (at least from the authorities’ perspective) with a standardized EU-wide measure. According to the impact assessment for the EU Commission from 2022, the e-invoicing has proven to be the most advantageous over other measures (e.g. SAF-T or real-time reporting). The aim of e-invoicing is to enable VAT relevant data to be recorded in an electronic reporting system in the future. However, this central data collection is still some way off and will only become a reality between 2028 and 2032.

What is an e-invoice?

In common language, an e-invoice is often understood as an invoice document that is not issued in paper format but has been generated as a PDF document or the like. However, the requirements for e-invoices go far beyond the commonly used electronic data format and will generally have to comply with the specifications of the CEN standard 16931. At the very least, e-invoices must guarantee complete interoperability so that invoice data can be recorded in a standardized electronic reporting system in the future. According to Recital No. 8 of Directive 2014/55/EU of the European Parliament and of the Council of April 16, 2014, this requirement of full interoperability affects three different levels, namely the content of the invoice (semantics), the format or language (syntax) and the method of data transmission. Any commonly used electronic data format, such as PDF, cannot meet these requirements.

Who is affected by the e-invoicing and what does the timetable look like?

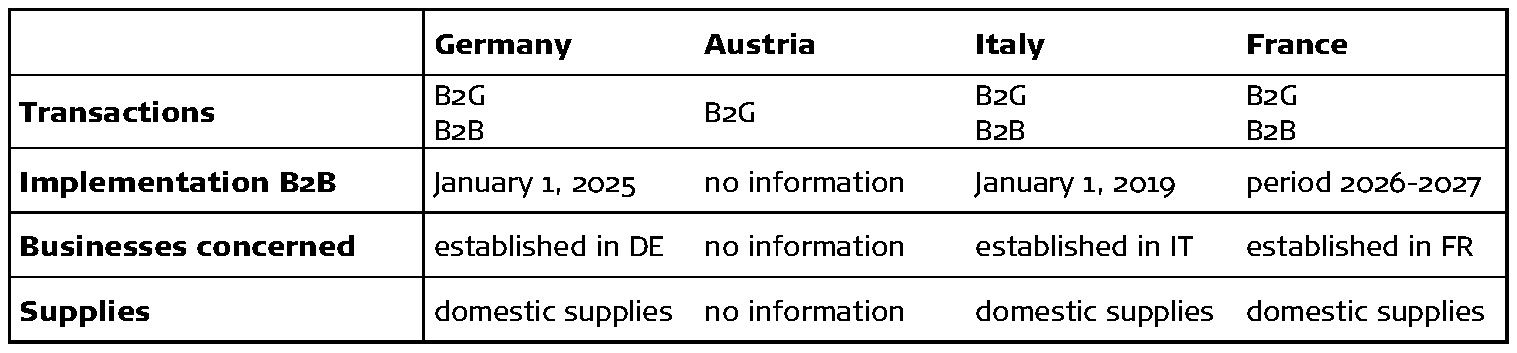

A look at the various EU countries shows that e-invoicing has often already been implemented in B2G relationships several years ago. In B2B relationships, the e-invoicing can be used on a voluntary basis in some countries or its introduction is still being discussed. B2C relationships, in which supplies of goods and services are invoiced to non-entrepreneurs, are not subject to e-invoicing regulations.

The e-invoicing will not be introduced across the EU consistently; it is the individual member states that are responsible for the implementation. This will result in different invoicing regulations in the member states, at least until the e-invoicing has finally been introduced EU-wide. The development in Switzerland’s neighboring countries can be summarized as follows:

What are the consequences of e-invoicing for Swiss companies?

At first glance, the current developments regarding e-invoicing, particularly in Switzerland’s neighboring countries, do not appear to affect Swiss companies. Even in Germany, where the e-invoicing will be introduced as early as January 1, 2025, the regulations only apply to supplies of goods and services among established companies. However, not only companies with a registered office in Germany are considered to be established. The existence of a fixed establishment for VAT purposes is sufficient for a company to be deemed as established; however, a German VAT registration alone is not sufficient to oblige Swiss companies to participate in the e-invoicing.

Nevertheless, this does not mean that Swiss companies with a VAT fixed establishment in Germany must be able to generate e-invoices as of January 1, 2025 already. A comprehensive obligation to issue e-invoices is not planned before January 1, 2028. Meanwhile, invoices can still be issued on paper or in other electronic formats, subject to certain restrictions. However, Swiss companies with a fixed establishment for VAT purposes must be ready to receive e-invoices from January 1, 2025. It is questionable what this “readiness to receive” e-invoices means in detail. Based on practical considerations, in addition to the mere readiness to receive e-invoices, a readiness to process them is also required. Otherwise, if an invoice recipient has not already implemented the necessary measures to process the data from e-invoices, it is questionable how, for example, a check of the invoice details and the correct posting can be ensured and ultimately the correct amount of input VAT be claimed. The challenges with the processing of invoices in an electronic format is not new in itself and is already known, for example, from files in XML-format. As with original documents in XML-format, also in the case of e-invoices it is the data in the original format that will be decisive for the proof of the VAT treatment applied. Documents that are only used by the invoice recipient for legibility purposes, such as the content of e-invoices in PDF format, will not have the necessary probative value.

Ultimately, not only Swiss companies with a fixed establishment for VAT purposes in Germany will have to deal with the question of how to handle the receipt and processing of e-invoices from January 1, 2025. Swiss companies not domiciled in Germany should also prepare for the e-invoicing, especially if input VAT shall be claimed in the context of the refund procedure on the basis of e-invoices. It cannot be assumed that German companies that switch to the e-invoicing at an early stage will continue to use other invoice formats for recipients abroad. Swiss companies must therefore be able to check e-invoices for formal correctness, archive them securely and submit them to the German tax authorities in the required manner as part of the input VAT refund procedure.

Conclusion

The standardized e-invoicing instrument is not only intended to reduce tax losses, but also to make the VAT system in the EU more efficient and less complex. There are still some question marks over the efficiency gains and simplification of the system from the perspective of the taxable persons. As the e-invoicing is being introduced in the EU member states in a decentralized and staggered manner, it makes it more difficult for companies to handle. Currently, the overall situation can be described as somehow confusing. However, it is certain that companies will incur considerable financial costs in order to meet the system requirements for receiving, processing and ultimately issuing e-invoices. For the sake of completeness, it should be noted that there are currently no plans to introduce in Switzerland an instrument similar to the e-invoicing.

<< Back to News