On January 1, 2018, the partially revised VAT Act enters into force. The main aspect first: for Swiss companies, the adjustments are minimal. The reform targets primarily foreign companies that render services in Switzerland, and can be grouped into three key areas:

1) Removal of competitive advantages for foreign providers of goods and services

The legislators have realized that, based on existing regulations, foreign providers can, to a certain extent, offer their goods and services VAT-free, giving them a competitive edge over domestic providers. The partially revised VAT Act aims to rectify this inequitable treatment by introducing the following regulations:

- Foreign-based providers of goods and services that generate turnover from goods or services in Switzerland will be subjectively liable to VAT for any taxable turnover generated in Switzerland if their global turnover exceeds CHF 100,000. Foreign-based companies that realize turnover in Switzerland therefore have to register in Switzerland for VAT purposes as of January 1, 2018. This effectively removes the local turnover threshold for foreign companies.

- Another change concerns the mail-order business, i.e., goods delivered into Switzerland. For economic reasons, the Swiss Federal Customs Authority does not levy a tax on imported goods with a tax amount of less than CHF 5. Which means that low-value deliveries into Switzerland are not taxed at present. Under the new regulations, foreign mail-order companies that realize turnover of more than CHF 100,000 per year from such (low-value) deliveries to Swiss purchasers are obliged to register in Switzerland for VAT purposes and to account for VAT on such turnover. However, this rule does not enter into force until January 1, 2019.

- Moreover, more stringent regulations apply for Swiss recipients of (foreign) services rendered in connection with real estate located in Switzerland (e.g., cleaning services, paintwork, masonry or electrical works etc.). If the foreign service provider is not VAT-registered, the Swiss recipient must account for the VAT accrued. This measure serves to ensure taxation and does not absolve the foreign provider of these services from registering for Swiss VAT.

Not included in this new regulation are domestic deliveries of goods by foreign suppliers. As before, the foreign supplier must charge VAT on such deliveries and has to register for Swiss VAT. A general reverse-charge obligation for services rendered by foreign companies will not be introduced.

2) Reintroduction of margin taxation and expansion of deemed input tax deduction

Margin taxation, which in the previous amendment of the VAT Act had been replaced by the deemed input tax deduction, is partially reintroduced. Margin taxation newly applies to collector’s items (including vehicles put into circulation more than 30 years ago), art objects, antiques and similar objects. Possible losses arising from the sale of margin-taxed objects can be deducted from the taxable turnover. Companies that deal with such objects now have to keep detailed accounts of purchases and sales once again.

The transitional arrangements for margin taxation provide for regular taxation when a used object is sold that has been purchased before 2018 and for which a deemed input tax deduction was claimed. When selling such an object abroad, the initially claimed input tax deduction on the purchase of the item must be corrected. Companies dealing with such objects are advised to make provisions for the correct handling of this tax matter during the transition period.

In return, the scope of application of the deemed input tax deduction has been expanded. Up to now, the deduction could only be claimed on customizable and used movable goods that had been purchased for resale purposes. Under the new rules, such a deduction will also be possible when buying customizable objects that are new and will serve operational purposes or when buying movable assets. This creates another possibility to compensate for a hidden value-added input tax.

3) Reduction of the VAT rate applicable to electronic newspapers, journals and books

The unequal tax treatment of the printed and electronic versions of newspapers, journals and books will be abolished. From January 1, 2018, electronic versions are treated the same as print versions from a VAT point of view. Companies selling electronic newspapers, journals and books will only have to charge the reduced VAT rate in future. The same applies to combined subscriptions that entitle to the use of both print and electronic versions.

4) Other notable changes

The partial revision also introduces other measures, of which we present the most important as follows:

- Foundations or associations will now qualify as closely related persons if they have particularly close economic, contractual or personal ties with each other or with companies. Although these types of legal status do not enable any control of capital, it means that in future the arm’s lengths principles apply. Services rendered for free or at a discount will now be subject to arm’s lengths provisions. Pension fund facilities are explicitly excluded from this new provision. They continue to be viewed as not closely related entities.

- Voluntary taxation of turnover (option) can now also be exercised by declaring it the amount correspondingly on the VAT return. The hitherto required open disclosure of the VAT rate on an invoice or in the contract is no longer the only way of exercising the option. This means that the correct statement of optionally taxed turnover in VAT accounting is substantially more significant than it has been so far.

- There are also changes in the area of public bodies, both in terms of their subjective tax liability, which applies only to turnover of more than CHF 100,000 in services rendered to non-public bodies, and in relation to staff secondment from one public body to another.

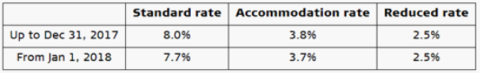

5) Tax rate changes as of January 1, 2018

As a result of the rejected pension reform bill, the following VAT rates apply as of January 1, 2018:

As was the case with previous adjustments to the VAT Act, the imminent reduction of the tax rates creates a need for action that cannot be underestimated. It concerns not just services begun at the end of the year, which have to be correctly allocated and accounted for at the higher tax rate, but also those relating to continuing obligations (e.g., subscriptions, leasing contracts, rents) that fall under both years (2017/2018).

Tax Partner AG

Zurich, September 2017