The reforms in the area of indirect taxes continue into 2019. While Switzerland is implementing the final element of the 2018 partial revision of the VAT Act – new regulations affecting mail-order companies delivering into Switzerland – and changes to the Radio and Television Act (RTVA) result in the introduction of a new fee as of January 1, 2019, the European Union’s reform agenda produces a whole string of adjustments. And last but not least, we shall discuss the necessary steps for Swiss companies in regard to the imminent Brexit.

Switzerland

1) Mail-order companies that deliver merchandise of limited value (low value consignments) into

Switzerland

The last element of the partial revision of the VAT Act entails new regulations for mail-order companies that deliver small consignments into Switzerland. This concerns those companies whose consignments into Switzerland are not subject to import tax because of their low value, i.e., because the Federal Customs Administration waives the levy for economic reasons. At present, this is the case when the consignment value would trigger less than CHF 5 in import tax.

For goods subject to the normal VAT rate of 7.7%, this translates into a maximum value of CHF 64 per consignment; for goods subject to the reduced rate of 2.5%, the threshold value per consignment is CHF 200.

As of January 1, 2019, the new regulations oblige mail-order companies that deliver their goods from outside of Switzerland to register with the Federal Tax Administration (FTA) for VAT purposes and to begin charging local VAT once they reach a turnover of CHF 100,000 from low value consignments that did not incur import tax.

2) Introduction of the radio-television fee for businesses (“broadcasting tax”)

The Swiss voters approved amendments to the Radio and Television Act (RTVA) on June 14, 2015. Among other things, they agreed to the broadcasting tax being collected not just from private households but also from companies domiciled in Switzerland. The broadcasting tax is calculated based on the total annual turnover declared to the FTA via the VAT returns. The FTA will collect the broadcasting tax and send out the corresponding invoices at the beginning of 2019.

Tax amount

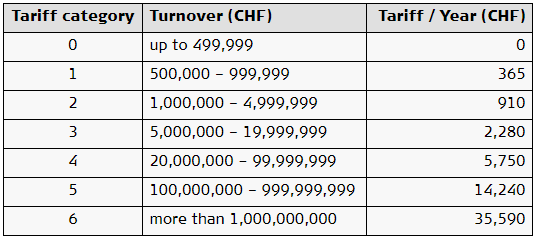

Companies with an annual turnover of less than CHF 500,000 are exempt from the broadcasting tax and will not receive an invoice. For all others, the following tariffs apply:

In introducing the broadcasting tax, the FTA will use the turnovers declared in calendar year 2017 to set the respective tariffs.

Relevant turnover

The relevant turnover encompasses turnover taxable in Switzerland, including exports; services abroad (e.g., services rendered to recipients domiciled abroad); as well as VAT-exempt turnover. Donations and subsidies, however, are not qualifiable as payment and need not be considered.

Entities that achieve only VAT-exempt turnover (such as schools, physicians, real estate companies) and therefore do not have a VAT number, seem to be exempt from the broadcasting tax, even if they might consume radio or television content (via the internet, among other things). It remains to be seen if the FTA will request the submission of turnover data from entities that are only liable for VAT due to services received from abroad.

This means that the declaration of turnover not subject to VAT (outside scope or VAT exempt turnover) in Switzerland becomes more important. Entities that up to now have paid little attention to the declaration of turnover made abroad or might have benefited from industry-specific regulations (e.g. insurance companies, health insurance companies) will have to declare their turnover comprehensively in the future.

VAT groups or broadcasting tax groups formed for the purposes of a tax reduction

Companies that have formed a VAT group or will form a group as of January 1, 2019, are deemed a single taxable entity for the purposes of the broadcasting tax. Thus, they pay a tax calculated on the overall turnover of the VAT group, not on the turnover of each individual group company. A company can therefore minimize the broadcasting tax burden. In return, the establishment of a VAT group and the subsequent consolidation of the individual VAT returns into one consolidated group VAT return will require some additional administrative efforts. The application for a VAT grouping of entities can be filed up until May 30th, 2019, provided that none of the companies to be included in the group has already filed its VAT return for the first quarter.

If a company does not want to or cannot establish a VAT group, it has the option to form a separate RTV business tax group (RTVA group). This will only be admissible, however, if at least 30 companies combine into such a group. It is important to note that the application for such a RTVA grouping has to be received by the FTA no later than January 15, 2019. The members of the RTVA group are collectively liable for the tax (akin to the collective liability of a VAT group.

Application for a broadcasting tax refund

Companies that fall under the aforementioned tariff category 1 and record an annual turnover of no more than CHF 3,650, or even a loss, may apply for a refund of the broadcasting tax. Such a refund application can only be made once the year in question has ended.

Beginning and end of the RTV business fee obligation

The tax is always payable for the full calendar year. If a company becomes newly liable for VAT in the course of a calendar year, it does not pay the broadcasting tax for the first year. Conversely, a company whose VAT obligation ends in the course of the calendar year has to pay the tax for the full year. Neither a prorated levy nor a prorated refund is possible.

Individuals and sole proprietors

The broadcasting tax is being levied on individuals as well as on sole-proprietor businesses with a turnover of more than CHF 500,000 and subject to VAT. This means that sole proprietors whose relevant turnover exceeds CHF 500,000 will pay the tax twice. A relief is not provided for in this case.

European Union

1) Status of the VAT reform in the EU

In October 2017, the EU presented a large package of measures for a fundamental reform of VAT rules within the EU. The aim of the measures is to reduce the VAT leakage estimated at about EUR 150 billion across EU member states. The reform is to be implemented in several phases.

2) 2019 changes

In a first step, companies that provide telecommunication, radio, TV or electronic services to individuals within the EU (the so-called e-services) will benefit from a simplified procedure. This consists of a newly introduced annual minimum turnover threshold of EUR 10,000 per EU member state.

Up to now, VAT had to be calculated at the locally applicable rate on any type of turnover of EUR 1 or more in the country where the recipient is domiciled. As of January 1, 2019, a bagatelle threshold applies. If the turnover achieved in an EU country falls below the threshold of EUR 10,000, the right to tax according to EU regulations lies in the country of the service provider.

From January 1, 2019, Swiss companies that previously generated revenues from e-services of less than EUR 10,000 per EU country will be able to collect these revenues tax-free. Up to this threshold, the e-services are neither liable for VAT in the country of domicile of their B2C client nor liable for Swiss VAT. In addition, companies that previously used the simplified Mini One-Stop Shop (MOSS) will be exempted from the mandatory information on invoices. The invoicing rules for these cases now follow Swiss regulations.

3) 2020 changes

From January 1, 2020, four so-called “quick fixes” will be introduced:

Call-off stocks

The different rules on call-off stocks in the various EU member states will be standardized. The use of call-off stocks will then require that

- the supplying party is not domiciled in the EU member state in which the call-off warehouse is located

- the acquiring party is VAT registered in the EU member state in which the call-off warehouse is located

- the goods are being withdrawn from the warehouse within 12 months.

In addition to the standardized criteria, in particular the withdrawal period, the simplification lies in the fact that such deliveries are treated EU-wide as zero-rated intra-Community supplies in the country of departure of the goods and as intra-Community acquisitions in the country of arrival.

This means that suppliers can terminate any registration obligation that might have been required in the country of arrival up to now. Supply of goods to the company’s own warehouse will therefore no longer be treated as a intra-Community transfer of goods with subsequent local delivery at the time of withdrawal

Chain transactions

For chain transactions, it will now be uniformly presumed that, in the case of a transport carried out by the intermediary entrepreneur, the intra-Community delivery is attributed to the first delivery (i.e. between A and B), provided that the intermediary entity (i) informs the first supplier of the country of arrival of the goods and (ii) is registered in an EU member state other than the member state where the goods were dispatched from.

Requirement for the application of the zero-rate in the case of inter-Community supplies

The application of zero-rate on intra-Community supplies will be formally standardized. It will now be available only if the invoice of the supplier states the VAT identification number of the recipient and the delivery has been duly declared in the EC Sales List (ESL). This means that the correct declaration in the ESL is of material importance.

Proof of the intra-Community supply

The requirements for proof of an intra-Community supply will become more stringent. If the first supplier carries out the transport of the goods, he needs to produce two non-contradictory transport documents – e.g. delivery contract and consignment note (CMR, airway bill, bill of lading, etc.) – or a transport document with the confirmation of receipt from the consignee or the warehouse keeper.

If the consignee carries out the transport (in the case of collecting the goods, or in a chain transaction with delivery by an intermediary entity), the consignee needs to produce two non-contradictory supporting documents. Alternatively, a supporting document and a written confirmation by the first supplier that he did not arrange the transport will suffice.

4) 2021 changes

In 2021, the thresholds for intra-Community distance sales within the EU will be standardized. The previous threshold of EUR 35,000 – EUR 100,000, which each EU member state could determine individually, will be set EU-wide at EUR 10,000. At the same time, the option to use a One-Stop Shop will become available: This should help minimize the number of new VAT registrations in other EU member states as a result of the lowered distance selling threshold.

5) 2022 changes

The current system whereby intra-Community supplies are zero-rated shall enter into force in a new form on January 1, 2022. Based on present plans, intra-Community supplies will be subject to the VAT rate of the country of destination and no longer zero-rated. This in combination with the One-Stop Shop option. If, for example, a Swiss supplier delivers goods from his German warehouse to Sweden, he will have to charge the 25% Swedish VAT rate. Since the Swiss distributor has a German VAT identification number, he will remit the 25% Swedish VAT to the German tax authority, which will then forward it to Sweden. The Swedish buyer, on his part, can reclaim the paid VAT amount as input tax from the Swedish tax authority.

If these adjustments will indeed enter into force on January 1, 2022 remains to be seen. In view of the financial troubles of some EU member states, an EU-wide clearing system of VAT payments and revenues seems not very likely.

Brexit – the exit is imminent

While the exit negotiations are still ongoing and nobody can yet safely predict whether the UK will remain in the EU Customs Union, the following points need to be observed already:

- If no agreement materializes on the UK’s accession to EU Customs Union, one can expect lengthy delays in the deliveries of goods to the UK since any merchandise moving from the UK to the EU and vice versa will have to be customs cleared. It is strongly recommended that goods to be delivered or installed in the UK shortly after the Brexit date be sent well in advance.

- If the UK has to leave the EU Customs Union, goods delivered into the UK as of March 30, 2019 will incur customs duties. In the absence of a free-trade agreement, there will be no preferential customs tariffs. As a consequence, customs duties of an unknown magnitude loom because the UK has not yet set its tariffs. By replenishing the UK warehouse or by making early deliveries to the UK, costs can be minimized at least in the transitional phase.

- If the UK has to leave the EU Customs Union, goods delivered into the UK as of March 30, 2019 will incur customs duties. In the absence of a free-trade agreement, there will be no preferential customs tariffs. As a consequence, customs duties of an unknown magnitude loom because the UK has not yet set its tariffs. By replenishing the UK warehouse or by making early deliveries to the UK, costs can be minimized at least in the transitional phase.

- For deliveries into the UK, the incoterms need to be checked. Since the place of departure of a delivery into the UK will change if a Swiss entity acts as the importer of the goods, the corresponding requirements also need to be examined.

- Should the UK remain in the EU Customs Union, EU customs clearance from Switzerland to the UK will no longer be possible. Whether the UK remains in the EU Customs Union only impacts the customs duties, not the VAT simplification rules.

- Companies that were previously registered only in the UK and used their UK number for intra-Community supplies or to benefit from simplification rules (e.g. triangulation simplification, Mini One-Stop Shop etc.) must apply for a new registration in other EU member states in timely fashion.

Companies that maintain business relationships with UK clients are advised to use the remaining months before the exit date for taking the requisite VAT and customs-related steps.

The following links will give you access to detailed information on the topic.

Trading with the EU if there’s no Brexit deal

VAT for businesses if there’s not Brexit deal

Tax Partner AG

Zurich, November 2018